Over the past couple of years, the UK Research & Development (R&D) tax credit schemes have been in the news constantly and often for the wrong reasons.

In this post, we take a look at issues created by alleged fraud and abuse of the UK R&D incentive schemes and changes introduced or planned to address these. The changes will mostly impact on the Small and Medium Enterprise (SME) R&D tax credit scheme. We also highlight the latest government statistics on the take-up and cost of UK R&D tax credits.

Tackling R&D tax credit fraud – a serious pursuit by HMRC?

At the end of October, the latest R&D tax credit fraud story hit the news, as eight people were arrested over alleged fraudulent claims, worth at least £16M. What’s disappointing about this is that as a result of HMRC attempting to deal with fraudulent activity, legitimate claimants had to suffer a summer of long-delayed claims and an intensification of scrutiny. Those of us that have been working in this field for many years have long felt that HMRC needed to improve how they check claims – the jury is out on whether their attempts to do so now are sufficiently well thought through.

R&D Tax Credits – what are the new anti-fraud measures?

The first anti-fraud measure was the re-introduction of a cap on the SME payable R&D tax credit. It applies for company accounting periods beginning on or after 1 April 2021. The cap limits the amount of a payable tax credit per claim year (i.e. the cash payment paid against a surrendered trading loss). The limit is set at £20,000 plus three times the company’s Pay As You Earn (PAYE) and National Insurance Contributions (NICs) made in the relevant R&D claim year. So the cap does not prevent a claim, it just restricts the amount of cash that can be paid. Any additional losses, that remain un-surrendered as a result of an R&D claim, can be carried forward, with the benefit of reducing future corporation tax liabilities. A £20,000 R&D tax credit (cash payment) is still a significant amount of money for many SMEs, even if they are capped.

Other changes that are expected to become law for accounting years starting on or after 1st April 2023 include that claimants will no longer be allowed to include the cost of foreign-based contractors or employees in their R&D costs (with a few very specific and limited exceptions). For some companies, that rely on sub-contracting cheaper development services from abroad, this will have a big negative impact. HMRC has also announced that it will require all R&D claims to be supported by a cost breakdown and a narrative saying what the R&D projects/activities were and why they qualify (good quality R&D specialist service providers already ensure their clients comply with this). Claims will also have to be signed off by a senior member of staff in the claimant company.

How much do the R&D tax credit schemes cost?

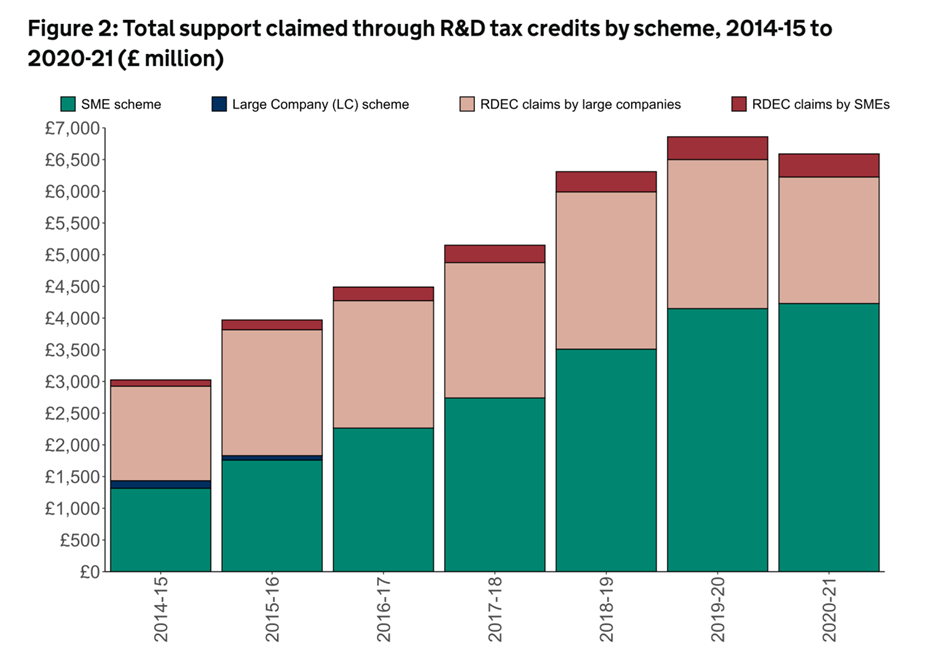

The latest government statistics on the two UK R&D tax credit/relief schemes were published in September 2022. For the first time in many years, the cost of the schemes decreased (see Figure 2 below).

“The total support claimed through both R&D schemes for the tax year 2020 to 2021 is estimated to be £6.6 billion (figure 2). This is a decrease of 4% from last year’s total of £6.9 billion.”

This dropback was despite a rise in the number of SME claims.

“Conversely, the provisional estimated total number of R&D tax credit claims for the tax year 2020 to 2021 was 89,300, an increase of 7% from the previous year. The increase is driven by a 7% rise in the number of R&D claims within the SME scheme to 78,825.”

The smaller scale of claims is generally attributed to the impact of Covid.

What does the future hold?

It’s impossible to know whether the new measures announced to tackle fraud will be sufficient to deal with all concerns and there are some fears that the government may use the excuse of fraud and abuse, to cut back on the schemes. The contrary argument is that supporting investment in R&D is still a critical factor in the longer-term success of the UK economy, and data seems to suggest the UK already lags behind other European countries on R&D investment. We can only wait and see what the fate of the UK R&D incentives may be, but in the meantime, they remain an important source of innovation funding for many companies.

If you have any questions or require assistance with an R&D tax claim, get in touch.