Articles and News

To keep up-to date with all UKBA articles, blogs and news subscribe to our newsletter.

bigstock–193760095

Concept Of An Escaped From Egg Of Young Chicken.colourful Easter

Do you have a 1st April to 31st March holiday year for your staff?

If you don’t (i.e. it is the calendar year or some other arrangement) then this is not relevant. If you do have a 1st April to 31st March holiday year in your business read on…… In the current 2017/18 holiday year you may have noticed that Easter is split over two...

What are the latest HR legal requirements business owners need to implement in April 2018?

For the SME community, the relevant scheduled changes from April 2018 are the rates paid for statutory purposes, a change to the tax treatment of payments made in lieu of notice, and the impact of new regulations from May regarding data protection of staff records....

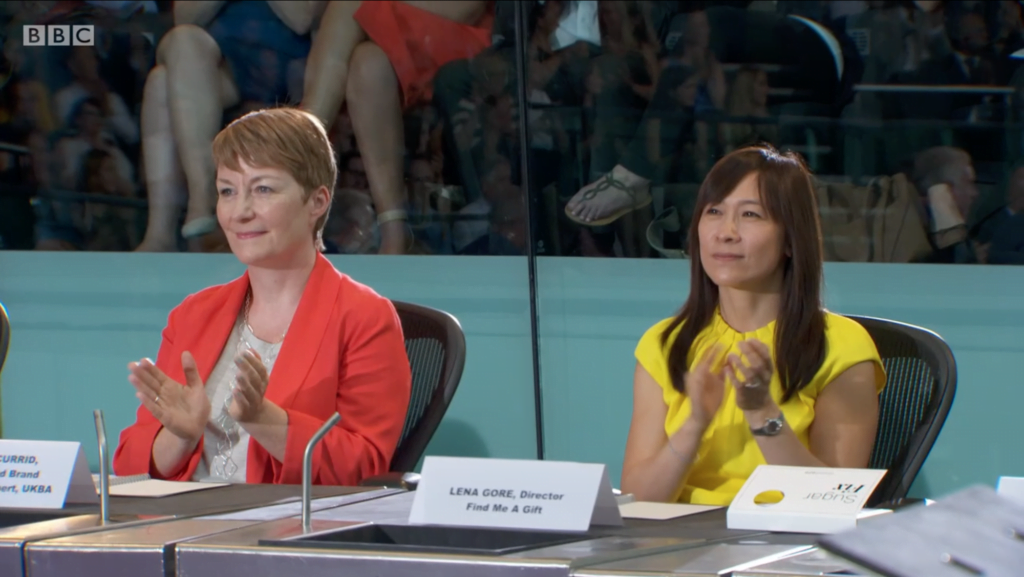

UKBA Marketing Advisor, Susanne Currid, Appears As Expert Judge On The Apprentice Final 2017

Congratulations to our colleague and marketing advisor, Susanne Currid who recently participated as an expert judge on the final of The Apprentice on BBC1. Susanne told us, “Back in June, I had a very unexpected email. A TV producer had got in touch and asked me if I...

Susanne-on-The-Apprentice.png

How To Set – and Keep – Your New Year’s Business Resolutions

Make twelve New Year resolutions for business, one for each month! By breaking them down into workable pieces, you’ll actually get them done. Our local Bollywood-style keep-fit class in my local area is led by Nikita, an instructor who has inspired me on more than one...

GDPR Check List – Your 8 Step Plan For The New Legislation

You need to start your preparations for GDPR (General Data Protection Regulation) as the implementation date of 25th May 2018 is fast approaching. For most businesses and IT managers, preparation has not yet started despite the deadline being less than 6 months away....

How do Research & Development Allowances (RDAs) help to buy buildings and equipment?

Research and Development Allowances can be claimed at 100% in year one, which means they provide a very generous cash releasing opportunity when you are purchasing fixed assets. Plus unlike the Annual Investment Allowance (AIA) they apply to buildings as well as other...

Expertise & Skills

Talk with an expert to get advice and guidance

Use the button below to contact UK Business Advisors to learn how our experts can help you with your business. We will ensure that you are linked with the right local advisor or national expert.