The Pressure Is Still On

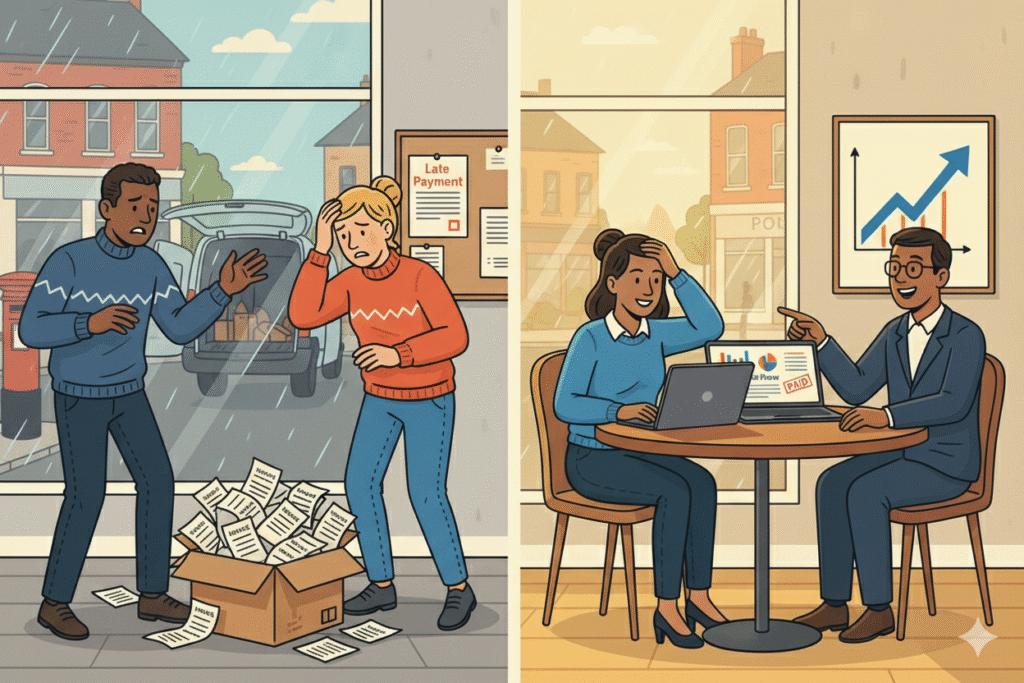

Small businesses keep the UK economy moving but many are still facing daily struggles. Cash is tight, costs are up and late payments continue to hold back growth.

Despite new laws aimed at protecting SMEs, late payments and cost pressures remain among the most serious threats to small business survival today.

What’s Really Going On?

The government’s mid-2025 action plan made bold promises:

- A legal cap of 60 days (moving to 45) for invoice payments

- Fines for persistent late payers

- A 25% cut in admin burdens for SMEs

- Better access to finance and more help with rising costs

Yet on the ground, the results are mixed.

- 70% of SMEs still report late payments

- Average wait: 46 days (up from 34)

- £97,000 is owed per SME on average

- That’s £50 billion trapped in unpaid invoices

- 38 SMEs close every day due to late payments

At the same time, the cost of doing business has jumped:

- Electricity bills average £3,000 a year

- Gas adds another £950

- Labour and supply chain costs remain high

For most SMEs, these pressures mean difficult decisions: cut back, raise prices or delay investment.

The UKBA Perspective

UK Business Advisors (UKBA) work directly with owners who face these daily realities. We know that good advice — at the right time — can unlock a way forward.

The real issue is cash flow confidence. When money stops flowing, businesses stop growing. And chasing payments isn’t what most entrepreneurs signed up for.

That’s where targeted support makes all the difference.

Three Moves to Make Now

- Tighten Up Your Credit Controls

- Send clear invoices with payment terms

- Use automated reminders

- Offer small early-payment discounts or apply interest for late payments

- Credit-check new clients and limit exposure

- Control Your Costs Strategically

- Review energy use, negotiate better supplier deals

- Use forecasting to plan ahead and manage risks

- Don’t wait for a crisis. Use scenario planning

- Call in an Expert Advisor

UKBA advisors help SMEs:- Improve credit and invoicing processes

- Prepare funding applications or negotiate payment plans

- Identify savings and avoid future risk

- Build strategies that balance survival and growth

Why It Pays to Ask for Help

Working with a UKBA advisor means more than getting advice. It means getting solutions tailored to your business.

When late payments pile up or costs spiral, it’s easy to feel stuck. A fresh pair of expert eyes can help you spot issues early, take action, and feel in control again.

The Bottom Line

Government action is welcome, but change is slow and your business can’t wait.

If you’re facing cash flow stress or rising costs, take one step today:

- Tighten your invoicing

- Review your cost base

- Or reach out for a confidential conversation with a UKBA advisor

Your business deserves more than survival. Let’s build it to thrive.